Reasons to invest in Brzesko

Our advantages

– outstanding transport links: direct access to A4 motorway, two national roads (DW 75 and DW 94) and a railway line. There is about 45 minutes’ distance to the international airport Kraków – Balice;

– proximity to large business centres: Kraków (60 km), Nowy Sącz (55 km) Tarnów (30 km);

– over 3000 business entities;

– long lasting industrial tradition;

– secondary schools with technical profiles;

– relatively low cost of living;

– extensive sports and recreational facilities.

– geothermal sources

Average monthly gross salary in 2022

- Poland: 6708 PLN

- Malopolska: 6825 PLN

- Brzesko Commune: 5128 PLN

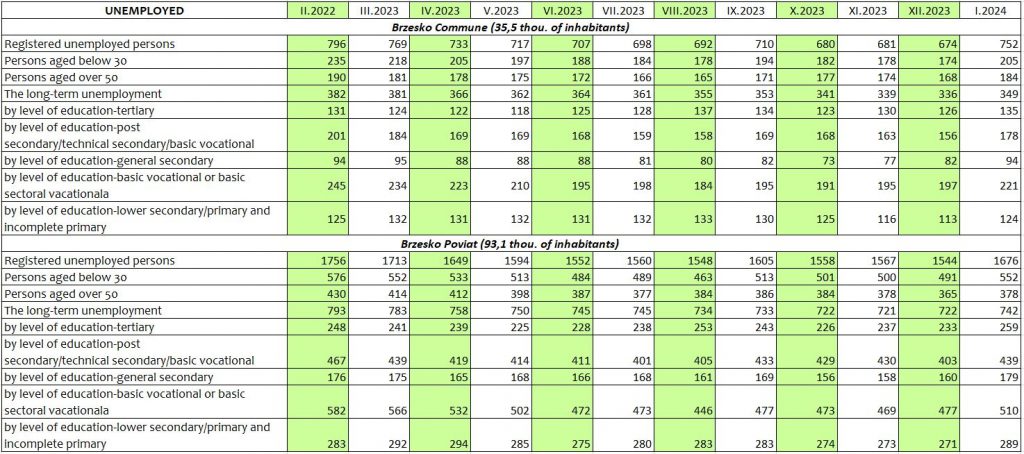

Unemployment rate in 2022

- Poland: 5,2%

- Malopolska: 4,5%

- Brzesko Commune: 5,6%

Human potential, education

There are 12 Primary Schools, Secondary Schools Complex, and Technical Secondary Schools (TSS) Complex in the Brzesko Commune. The TSS is open to training students in accordance with the needs of the factories operating in the vicinity. Now, the school educates construction technicians, electricians, surveyors, IT specialists, mechatronics, programming and robotics specialists.

The leading universities in Poland are located in Krakow (60km away from Brzesko Commune): Jagiellonian University, AGH University of Science and Technology, Cracow University of Technology.

There is a University of Applied Sciences in nearby Tarnow (30 km). The education at the University is focused on automatics and robotics, computer science, electrical engineering, electronics and telecommunications, materials engineering, mechatronics, chemical technology).

Leisure time

Facilities for the inhabitants include an indoor swimming pool, tennis courts, bowling alley, courts with artificial turf, full-size sports halls, equestrian centres, tourist routes and fishing ponds.

There are also the Regional Library and Cultural Centre, a cinema, the Regional Museum, restaurants and pubs in the town. Kraków which is situated just 60 km from Brzesko has one of the best cultural offers in Poland. Zakopane, the winter capital of the Polish Tatra Mountains is located 120 km from Brzesko.

Support for investors

Tax breaks for Małopolska entrepreneurs. Kraków Technology Park aids companies

Do you run an enterprise in Małopolska or Jędrzejowski County? Come to Kraków Technology Park and find aid: you can be relieved from your Company Income Tax (CIT) or Personal Income Tax (PIT).

Investments make sense in Małopolska, where you can exploit the tax breaks as part of the Polish Investment Zone (Polish acronym: PSI) – an aid programme for investors, operated by the Kraków Technology Park.

Who can apply for aid?

Aid is available to entrepreneurs want to:

- open a plant

- increase production capacity of their plant

- introduce new products

- change the process of production.

What sectors can apply for aid?

Companies from a broad variety of sectors are welcome. Aid is available to nearly all production and logistics, and some service companies. The most recent investors in the Polish Investment Zone include those from:

- traditional sectors (automotive, transport and chemical industries, and the food sector; with producers of innovative baths, composite tanks, furnishing, and wooden and metal components also notable)

- service sector companies (IT, R&D in natural and technical sciences, accounting and controlling of books, services in bookkeeping (with the exception of tax statements), technical research and analysis, call centres, and architectural and engineering services).

Who issues the decision about granting aid?

The decision to provide aid within Małopolska Region and Jędrzejowski County (in Świętokrzyskie Region) is issued, following an application from the entrepreneur, by the Kraków Technology Park on behalf of the minister proper for the matters of economy.

What is the actual aid an enterprise receives?

The value of public aid in the area operated by the KTP (CIT/PIT breaks) amounts to:

- *35% for large

- *45% for medium-sized

- *55% for small and micro-enterprises

counted on the investment outlay incurred.

For example, a small enterprise investing PLN 5 million into land, construction of plants, and purchase of the necessary equipment, will receive PIT or CIT break of PLN 2.75 million to be used during 12 or 15 years. This means that the entrepreneur will pay no tax until the limit of PLN 2.75 million has been consumed.

Kraków Technology Park provides assistance irrespective of the location of investment. email: strefa@kpt.krakow.pl tel. +48 690 950 600 and +48 12 345 32 23

Direct link to additional information on the Polish Investment Zone: https://www.kpt.krakow.pl/polska-strefa-inwestycji/informacje-podstawowe/

Invest in Małopolska, exploit the breaks!